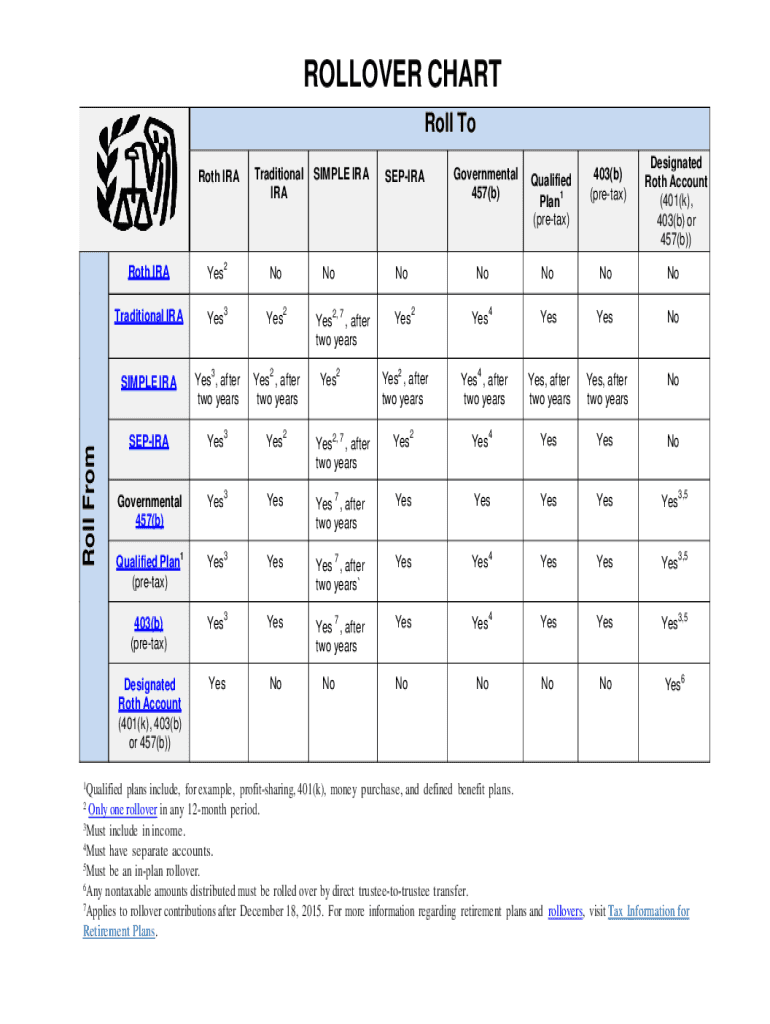

The 5-year Rule: What You Need to Know. While the contributions to a Roth can be withdrawn at any time, you can't touch the earnings unless the account's been open for at least five years. So, if you're rolling another retirement account into a Roth IRA in 2023, make sure you don't need the earnings until at least 2028.. You may have made a capital gain, capital loss, or you may be entitled to apply an exemption or rollover. For most CGT events, you make a: capital gain if the amount of money and property you received, or were entitled to receive, from the CGT event was more than the cost base of your asset; you may then have to pay tax on your capital gain

Writing Religious Exemption Letters

Uniform Exemption Letter for Workers, Students, Employees

What You Need to Know If You Have Applied for an Exemption During COVID19

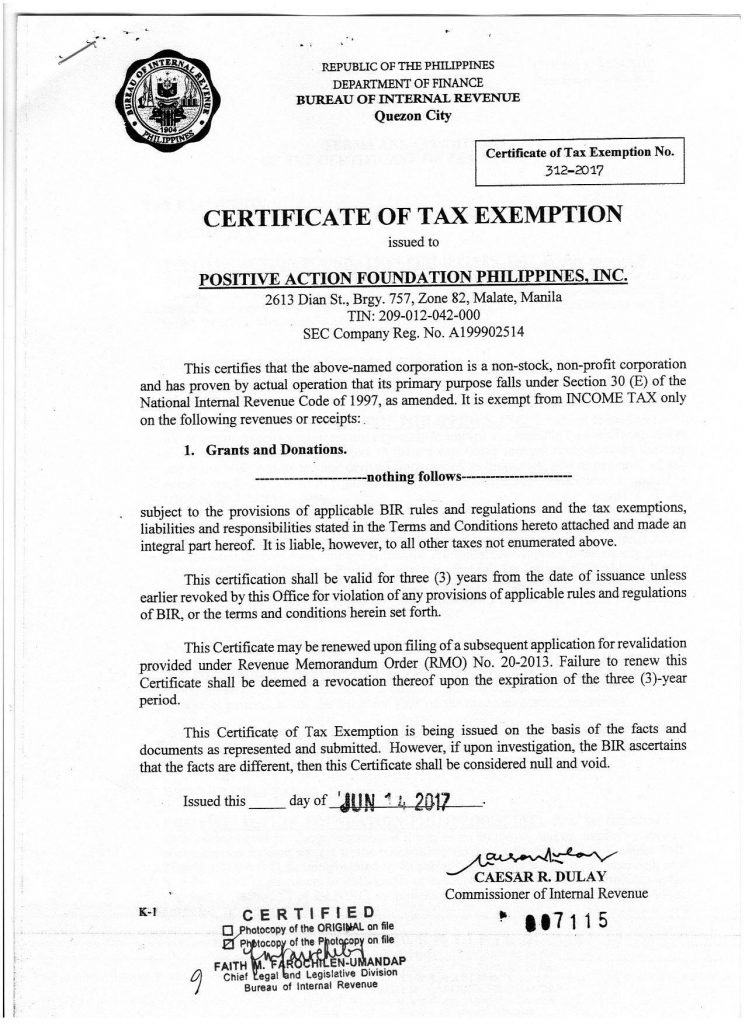

Certificate of TAX Exemption PAFPI

Irs Releases Form 1040 For 2020 Tax Year Free Download Nude Photo Gallery

Irs Rollover Form Fill Out and Sign Printable PDF Template airSlate SignNow

University exemption request form in Word and Pdf formats

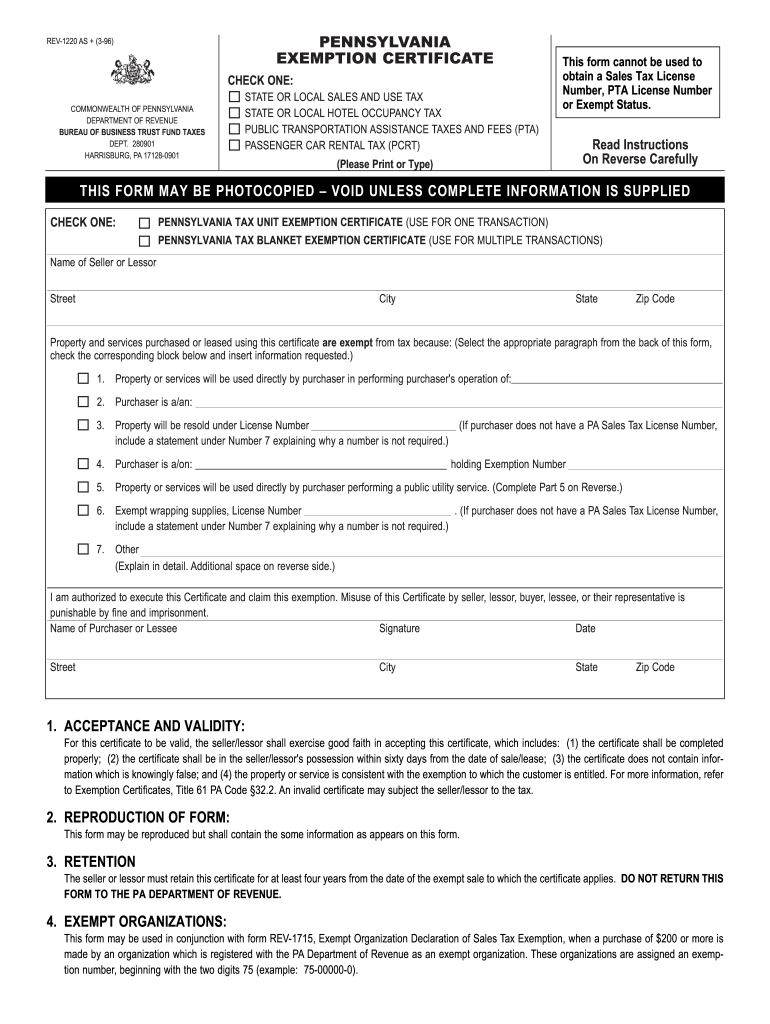

Pa Exemption Certificate Form Fill Out And Sign Printable PDF

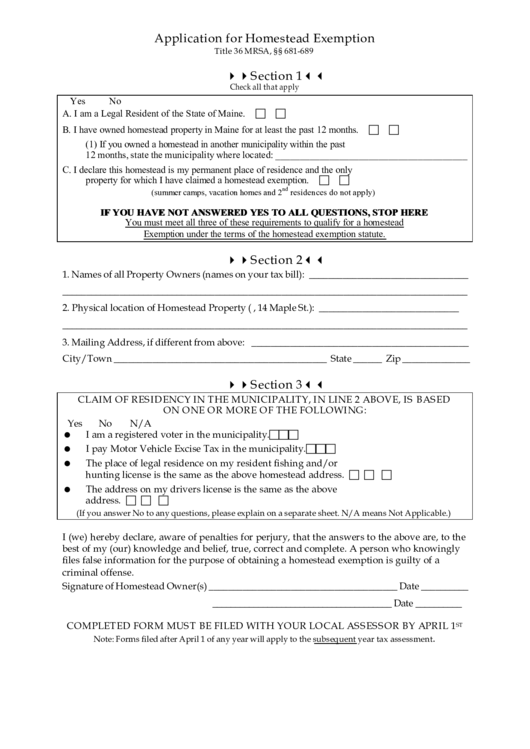

Homestead related tax exemptions Fill out & sign online DocHub

Ncua Letter Exemption Form Fill Out and Sign Printable PDF Template signNow

Fillable Application For Homestead Exemption Template printable pdf download

LTA on Twitter "HAVE YOU APPLIED YET!? If not, today is your last chance to Register for

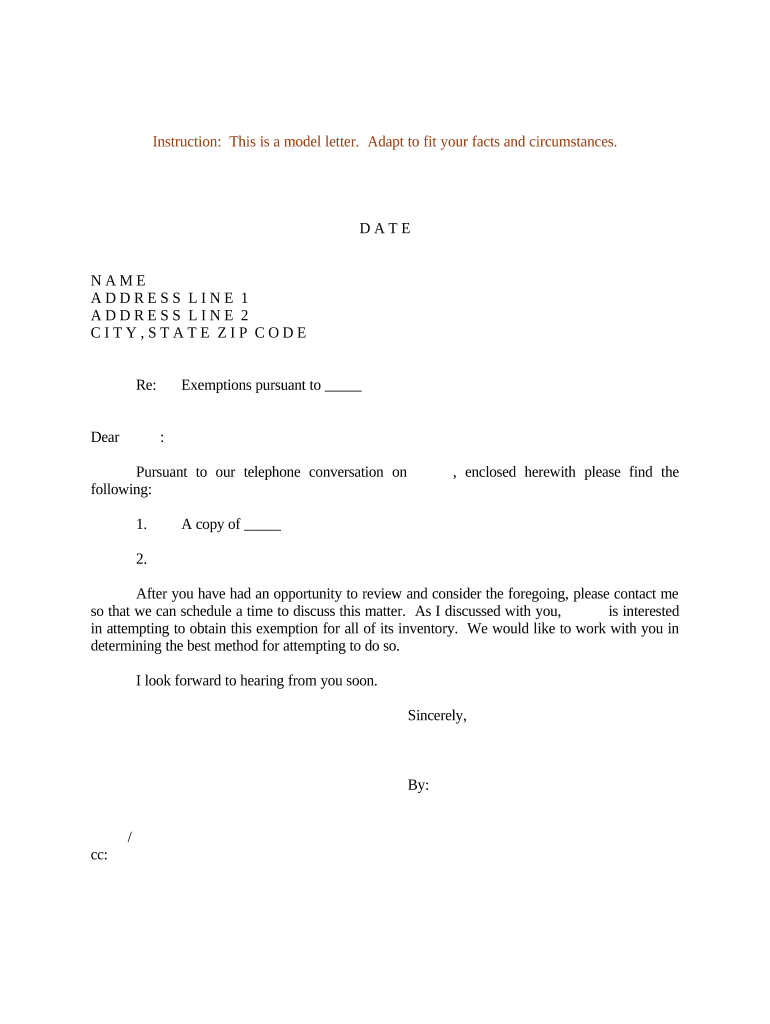

sample letter exemption Doc Template pdfFiller

Deadline coming up for seniors to apply for enhanced STAR exemption

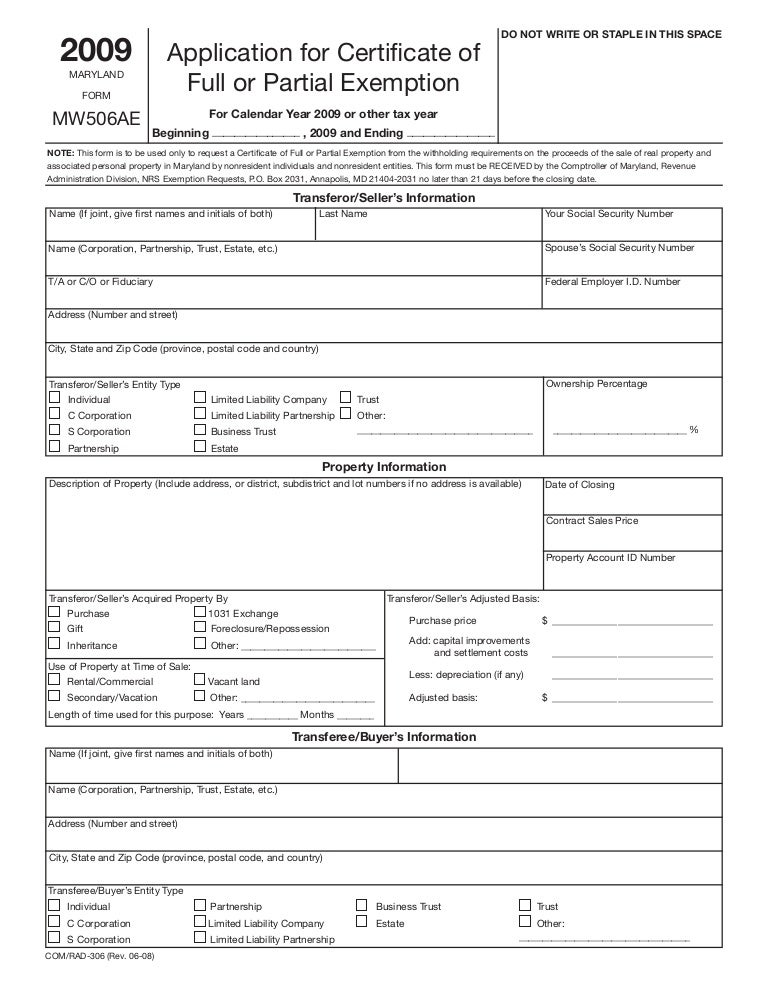

Application of Full or Partial Exemption

Sample Letter Exemptions Form Fill Out and Sign Printable PDF Template airSlate SignNow

[Texas sales tax exemption certificate from the Texas Human Rights Foundation] Page 1 of 2

FREE 10+ Sample Tax Exemption Forms in PDF

Sample Letter Tax Exemption Form Fill Out and Sign Printable PDF Template airSlate SignNow

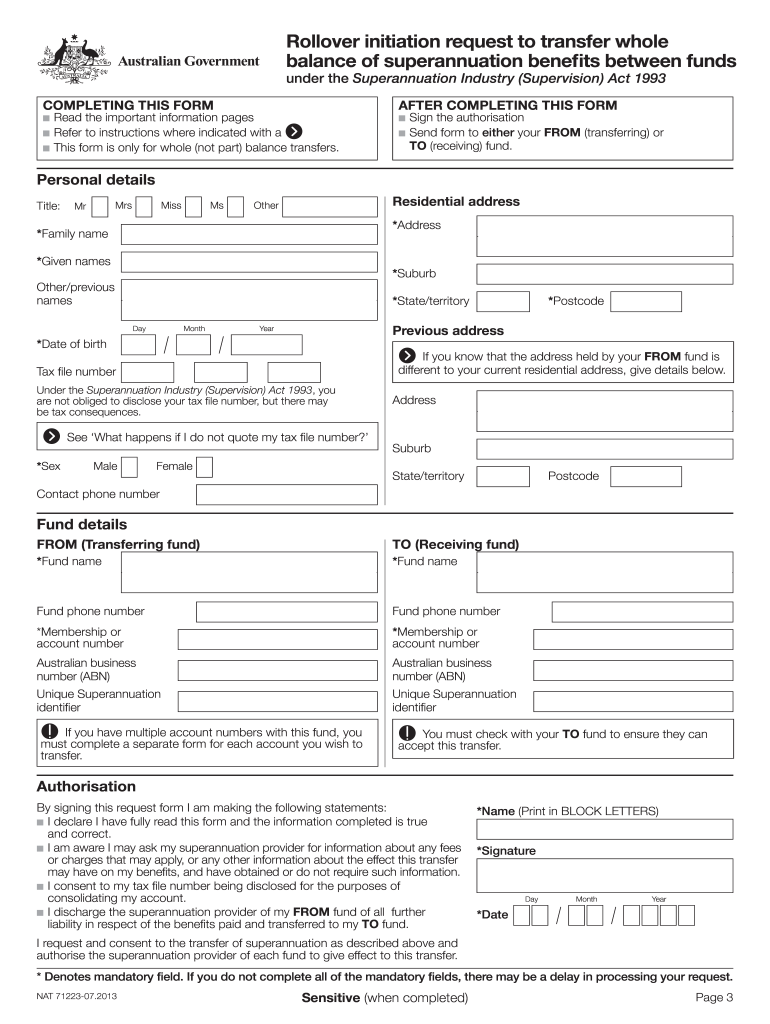

Ato Partial Rollover Form PDF Fill Out and Sign Printable PDF Template airSlate SignNow

If the fund has capital gains disregarded or deferred as a result of an application of a CGT exemption or rollover, print X in the Yes box at M.Otherwise print X in the No box. If you selected Yes you may need to provide details of certain CGT exemptions or rollovers, if you are required to lodge a Capital gains tax (CGT) schedule 2016.. Print in the code box at M the appropriate CGT exemption.. What's new. Find out what's new or any changes in legislation that need to be taken into consideration for 2022. Part A - About capital gains tax. Explains capital gains tax obligations including if it applies, how to work it out, what records you need to keep etc. Part B - Completing the capital gains section of your tax return.