tax purposes 5 NO - RESIDENT Alien for U.S. tax purposes ¹, ² Footnotes ¹ If this is your first year of residency, you may have a dual status for the year. See Dual Status Aliens in Pub 519, U.S. Tax Guide for Aliens. (Out of Scope) ² In some circumstances you may still be considered a nonresident alien and eligible for benefits under an.. For tax purposes, there are some important differences between resident and nonresident aliens. Your tax obligation as a resident alien in the U.S. is that you report and owe taxes on your entire income (regardless where it was earned). This income is reported using IRS Form 1040. On the other hand, the non-resident alien tax rate only applies.

PPT Tax Responsibilities for International Students PowerPoint Presentation ID619010

Am I a UK Tax Resident? Statutory Residence Test Explained

What is tax? Definition and meaning Market Business News

US Tax Residency Rules

US Tax Residency Status Explained & How to Determine It

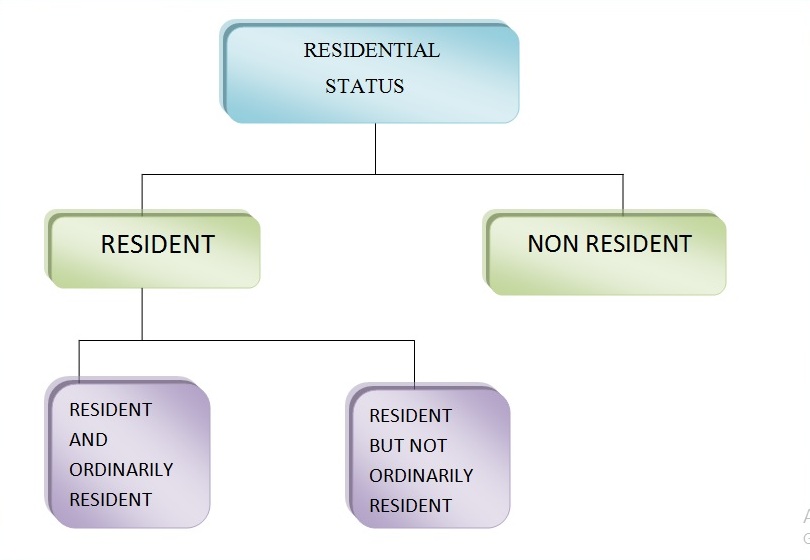

Residence Status of Individual

What is Tax Residence and Why Does it Matter? YouTube

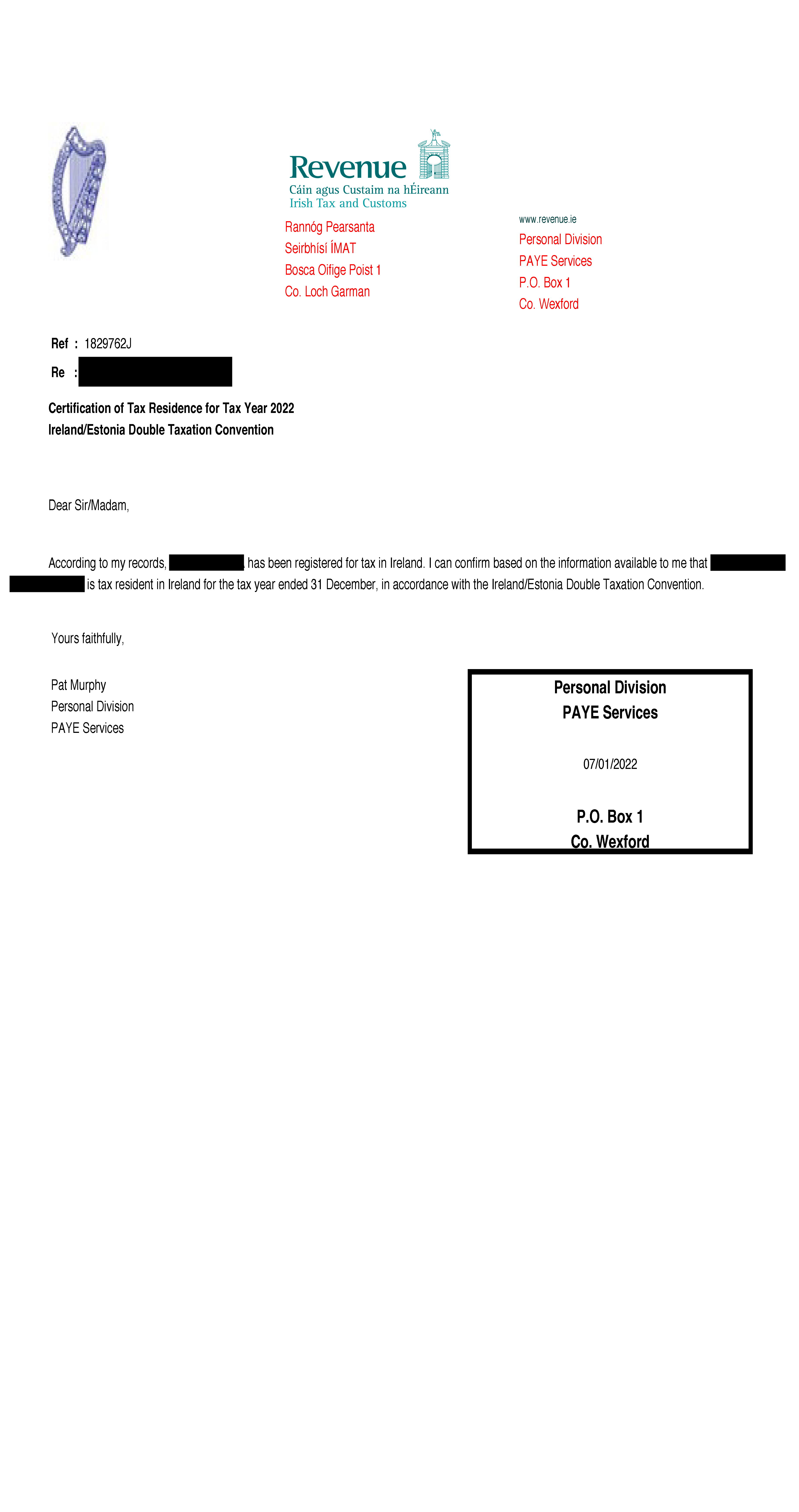

Tax Residency Certificate Features Meaning Types

Australian resident for tax purposes, explained.

Resident Tax, What is it? How is it calculated? How do I read it? When do I pay it

All you should know about tax residency certificates Crowdestate

:max_bytes(150000):strip_icc()/Term-Definitions_Income-tax-blue-9a708041207743b5a57cfdae08df2b10.jpg)

What Is Tax and How Are Different Types Calculated? Basic Concepts of Tax

How to determine Residential Status for Tax purpose Solve Tax Problem

Tax Treatments between a Resident & NonResident Company

Establishing Residency for State Tax Purposes Shakespeare Wealth Management, LLC

Am I a resident for Tax purpose? Australian Tax Office says

Nationality and Residency for Federal Tax Purposes

Are You a Tax Resident in Malaysia? Do You Need to Pay Tax?

Instructions For Form 1 Massachusetts Resident Tax 2013 printable pdf download

:max_bytes(150000):strip_icc()/Taxation_updated2-dfd2ae499d314d05972225d3f743f8aa.png)

Taxation Defined, With Justifications and Types of Taxes

The residency rules for tax purposes are found in Internal Revenue Code section 7701 (b). If you are not a U.S. citizen, you are considered a U.S. resident, if you meet one of two tests for the calendar year (January 1 - December 31). You meet the Substantial Presence Test (which is a numerical formula which measures days of presence in the.. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 - December 31). Certain rules exist for determining your residency starting and ending dates. In some cases, you are allowed to make elections which override the green card test and.