Subsequently, if less than 50% of the income received relates to personal exertion then the income is not Personal Services Income. Below is a list of some of the types of income that are not considered Personal Services Income: Sale or supply of goods; Income generated by income-producing assets (i.e. bulldozer hire). Income that is PSI. Personal services income (PSI) is income produced mainly (more than 50%) from your skills or efforts as an individual.

Taxation Personal Exertion Car Fringe Benefit, Interest on Loan and Capital Gain

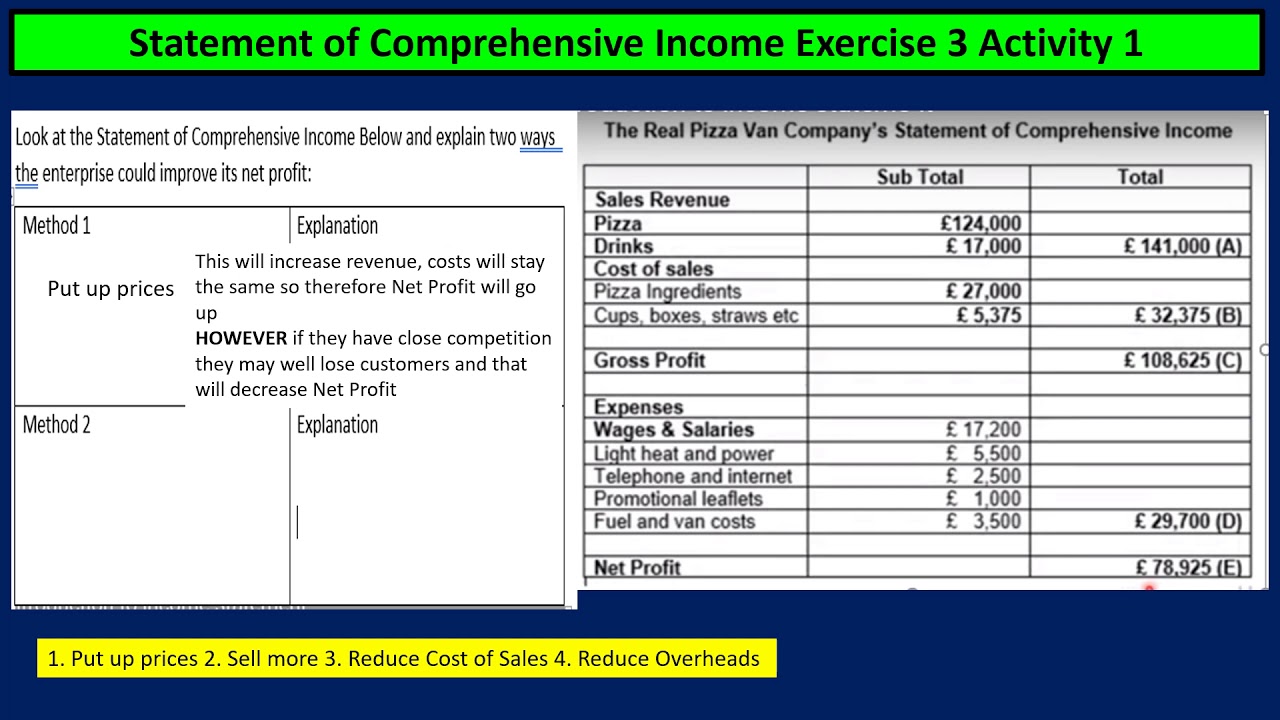

statement of comprehensive exercise 3 activity 1 worked answer YouTube

Exam sample Assessable Receipts from Personal Exertion Wages, salaries and commission S

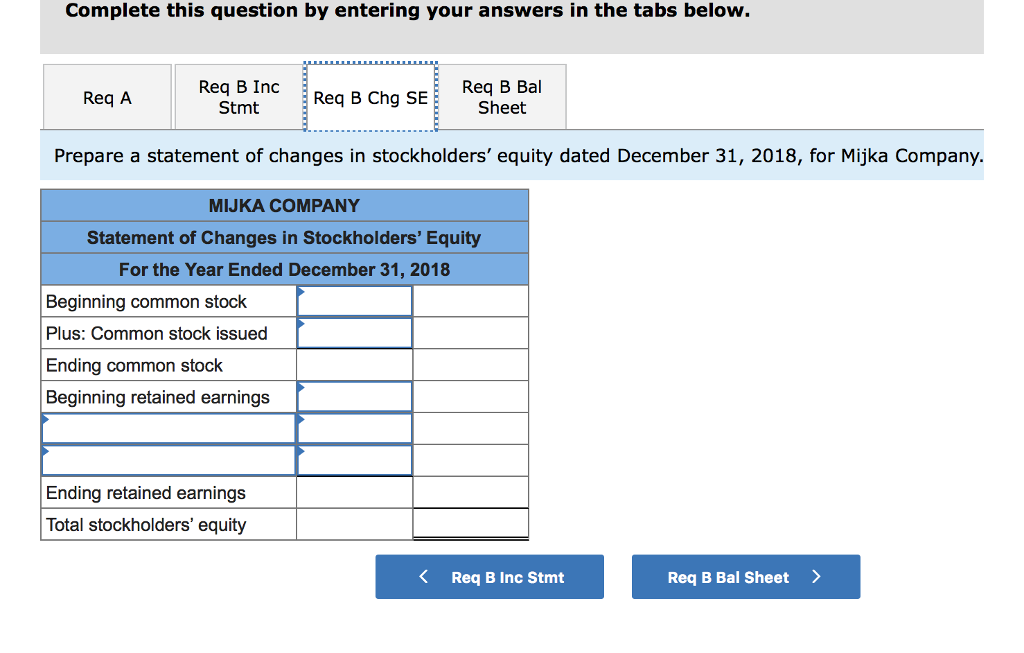

Solved Exercise 115 Preparing an statement and a

Pro Forma Statement Calculator Financial Alayneabrahams

Solved Spreadsheet Exercise The statement and balance

ADE Personal Services and Service Entity Arrangements

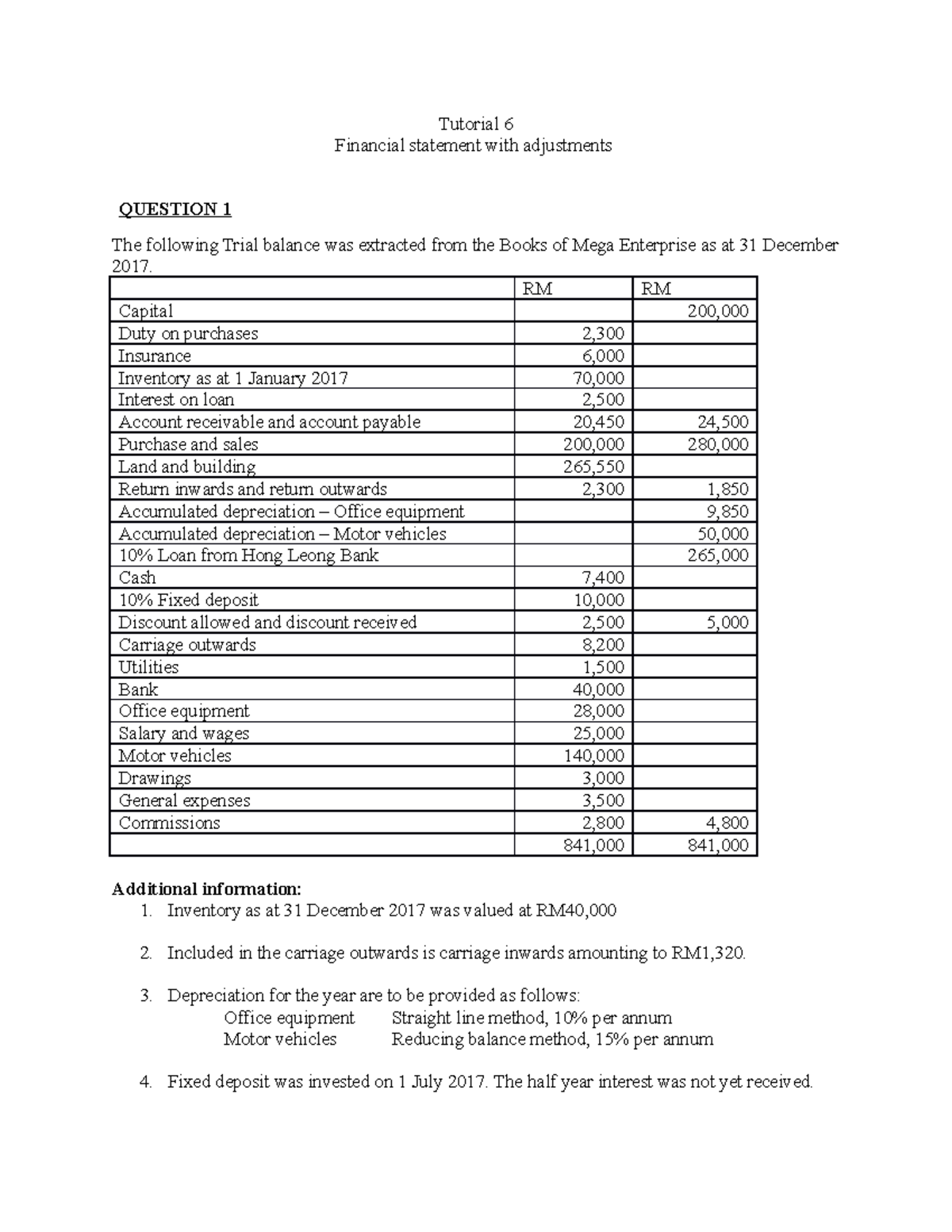

Exercise on Statement and Statement of Financial Position (question and answer

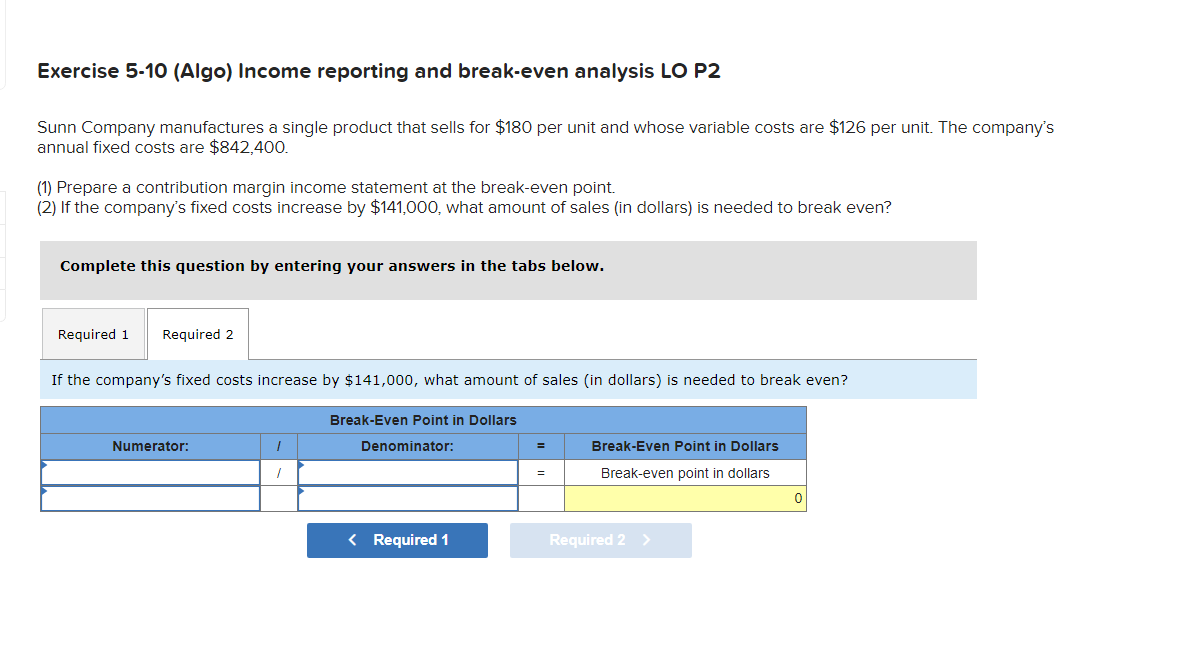

Solved Exercise 510 (Algo) reporting and breakeven

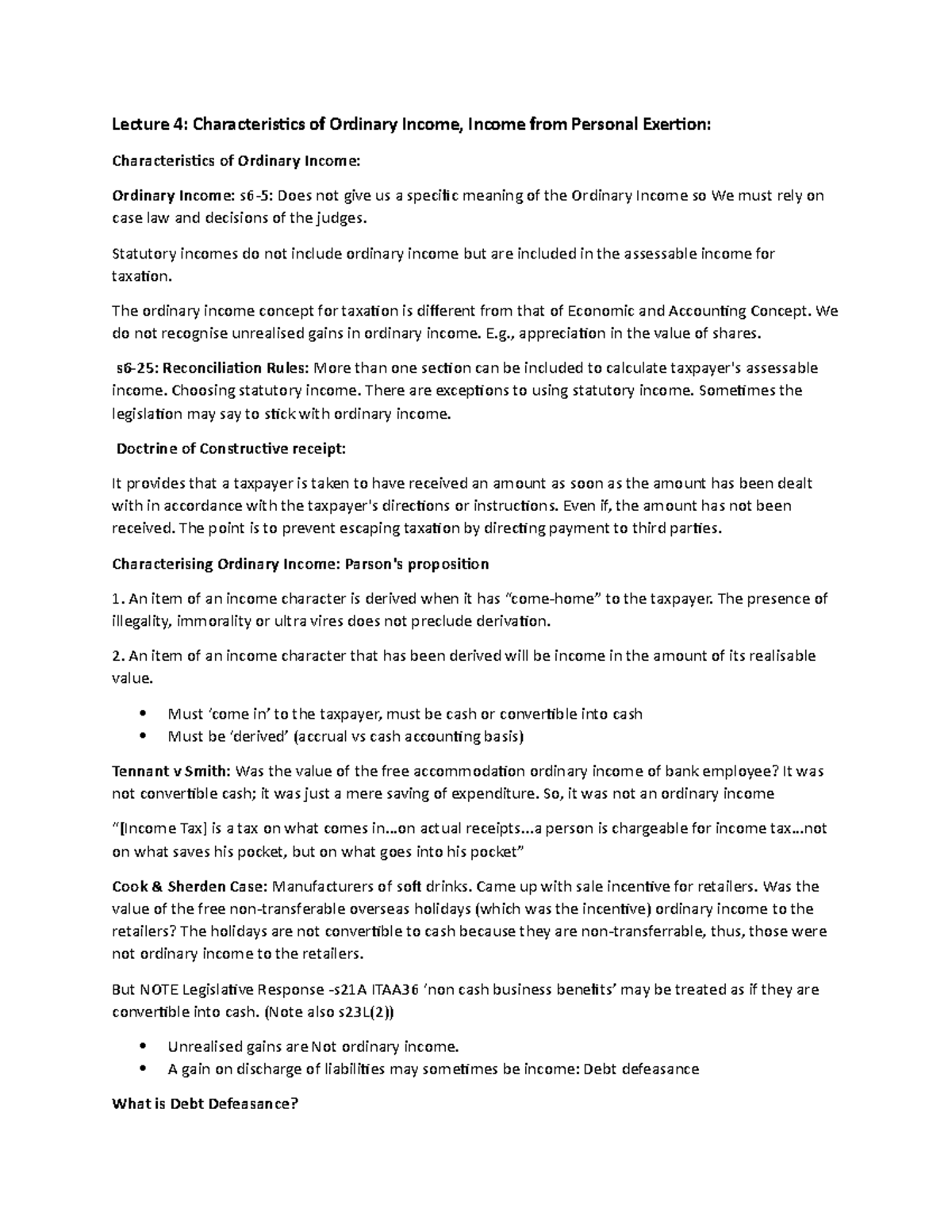

Lecture 4 Lecture 4 Characteristics of Ordinary from Personal Exertion Studocu

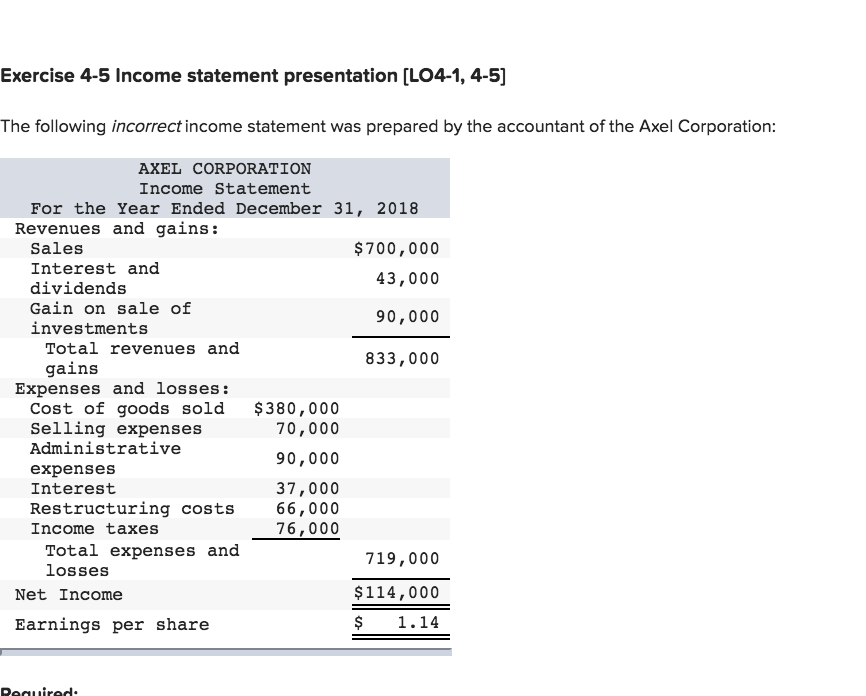

Solved Exercise 45 statement presentation [LO41,

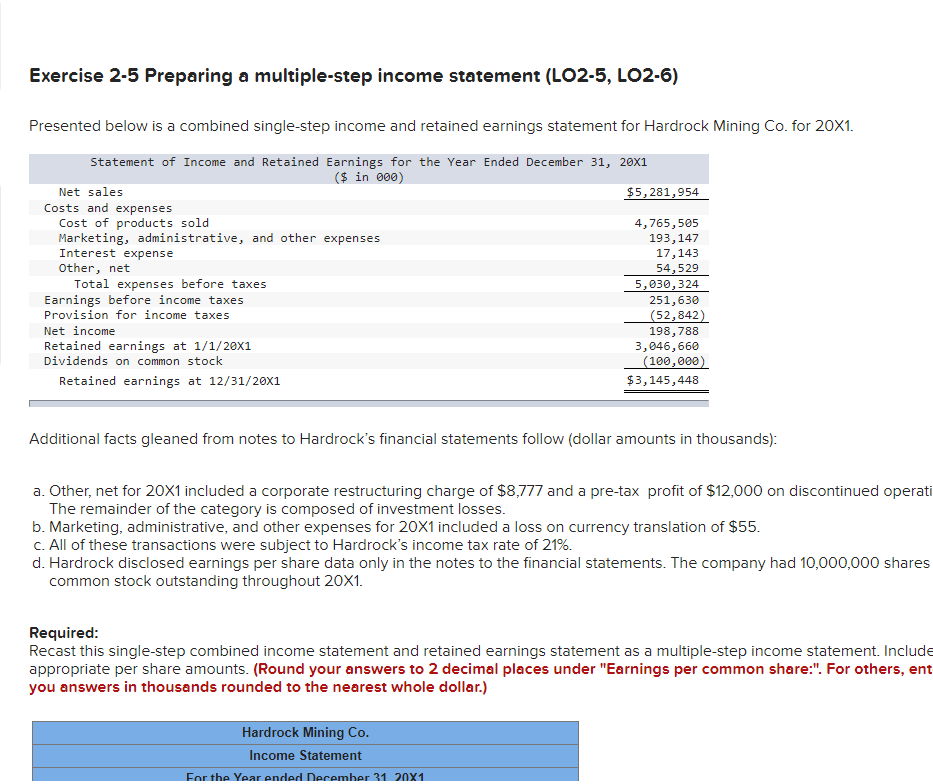

Solved Exercise 25 Preparing a multiplestep

Personal Services Test Ato Who Im I

How to Prepare an Statement Exercise YouTube

Week 3 Lecture notes 3 Week 3 From Personal Exertion; From Property; From Business

Module 2 Introduction to Personal LAWS 4008 Revenue Law WSU Thinkswap

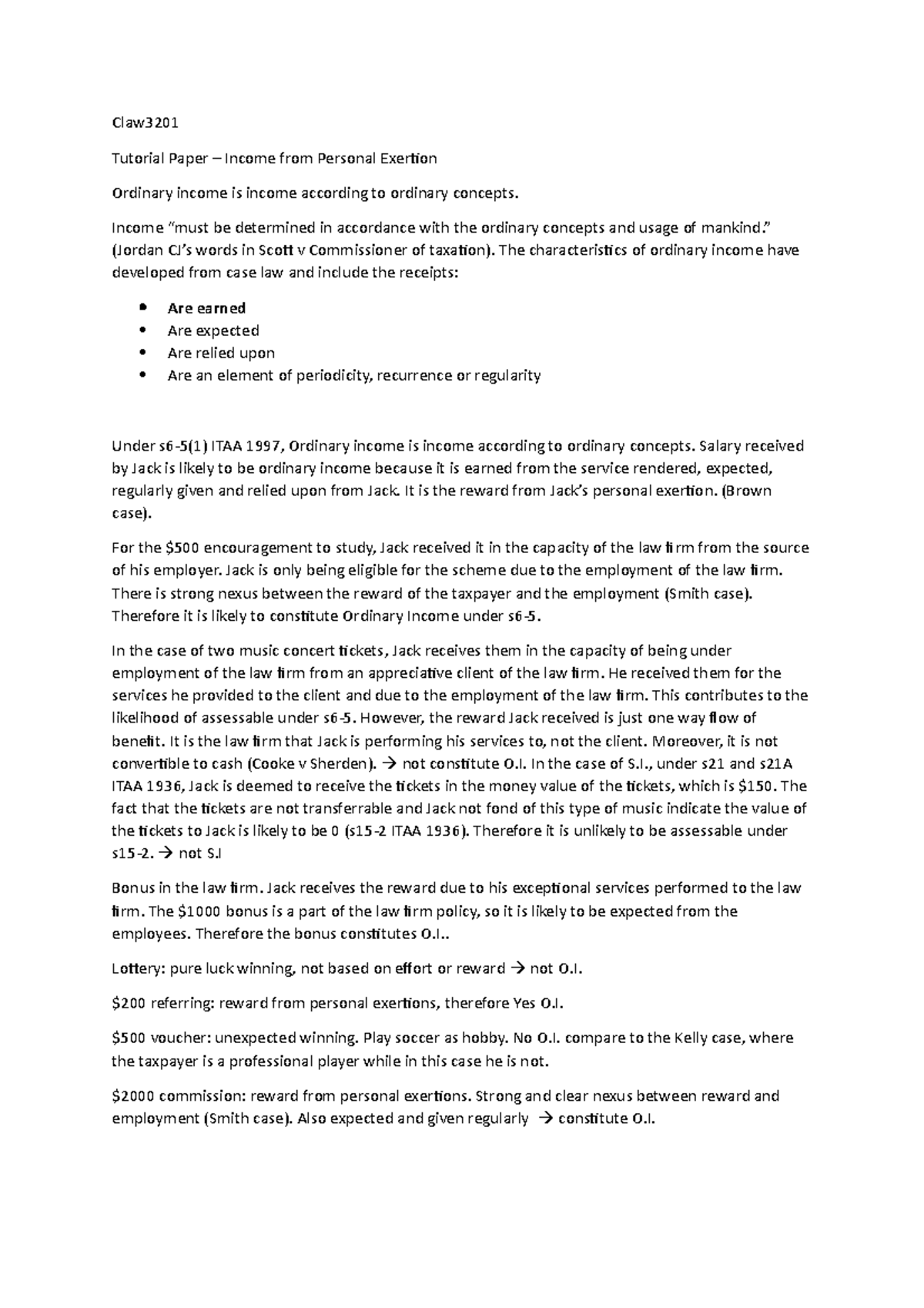

Claw3201 tutorial 2 Claw Tutorial Paper from Personal Exertion Ordinary is

Three Statement Model Links A Simple Model

Solved Exercise 43 (Algo) statement format; single

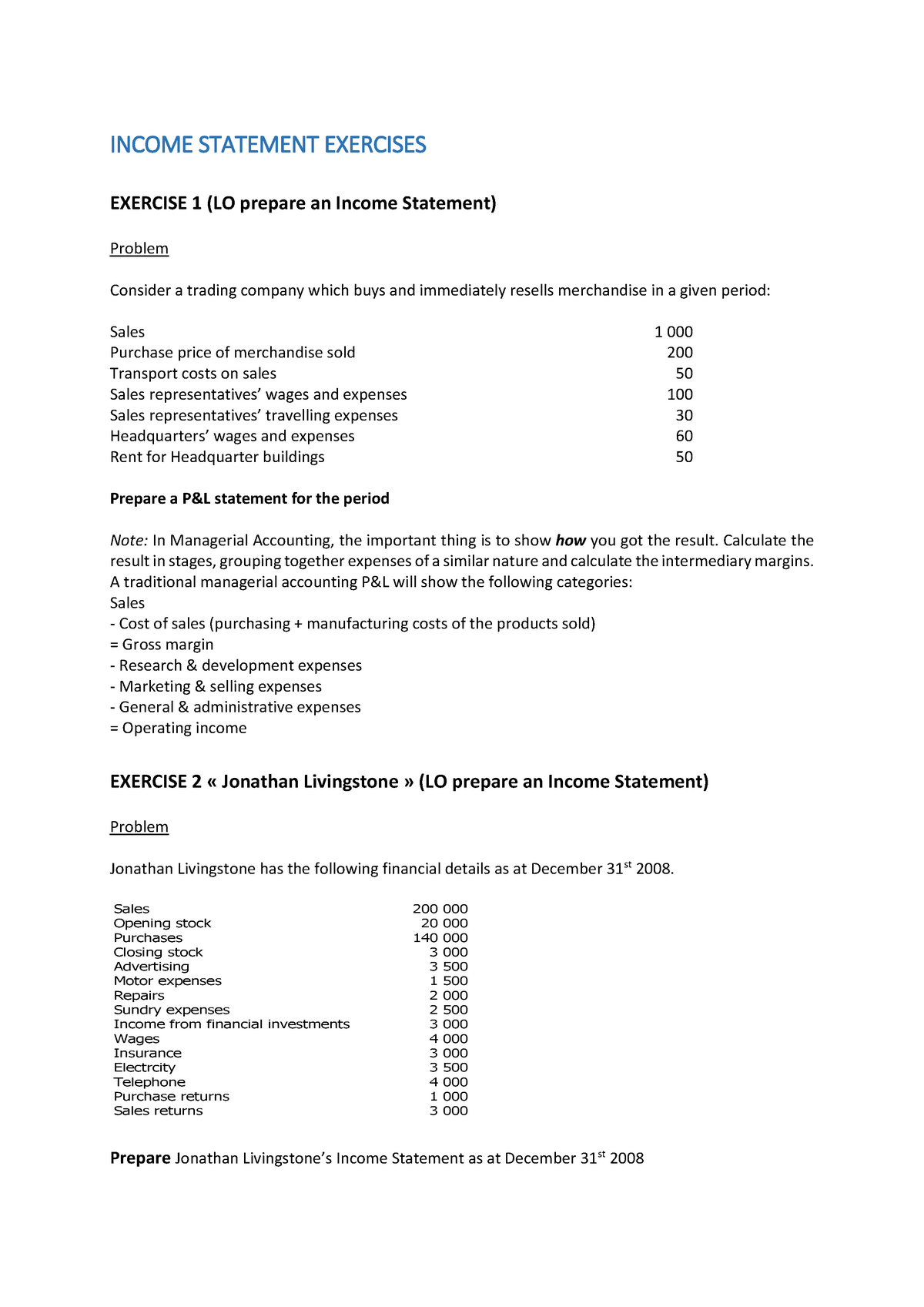

3 Statement exercises S TATEMENT E XERCISES EXERCISE 1 (LO prepare an

Common sense dictates that exercising regularly offers a whole host of benefits, one of which is an increase in your salary. However, your salary doesn't automatically go up just because you exercise. It still takes other skills, like being of value to your employer, negotiating skillfully and regularly seeking more opportunities to advance.. This article examines the validity of the personal exertion income rule and seeks to identify whether it applies to the more common income-splittin techniquesg Thos. e techniques usually comprise assignmen bty the taxpaye orf eithe thr e income-producin sourcg oer the right