Budget 2024 proposes funding of $6.1 billion over six years, beginning this fiscal year, and $1.4 billion per year ongoing, for a new Canada Disability Benefit. Advocates had been hoping for.. The maximum credit you can claim each year is: $1,200 for energy property costs and certain energy efficient home improvements, with limits on doors ($250 per door and $500 total), windows ($600) and home energy audits ($150) $2,000 per year for qualified heat pumps, biomass stoves or biomass boilers. The credit has no lifetime dollar limit.

Ultimate Guide to Mass Save® Rebates 2023 Colt Home Services

Take Charge Nl Heat Pump Rebate

Federal Rebates For Heat Pumps Save Money And Energy

Sa Heat Pump Rebate

Offering Expert Ductless Heat Pumps Repair and Installation

Massachusetts Rebates For Heat Pumps

Rebate For Installing Heat Pump

Energy Efficiency Rebate Options JPUD

Heating Services and Cover Archives HeatGeek

How long do heat pumps last? Pure Electric

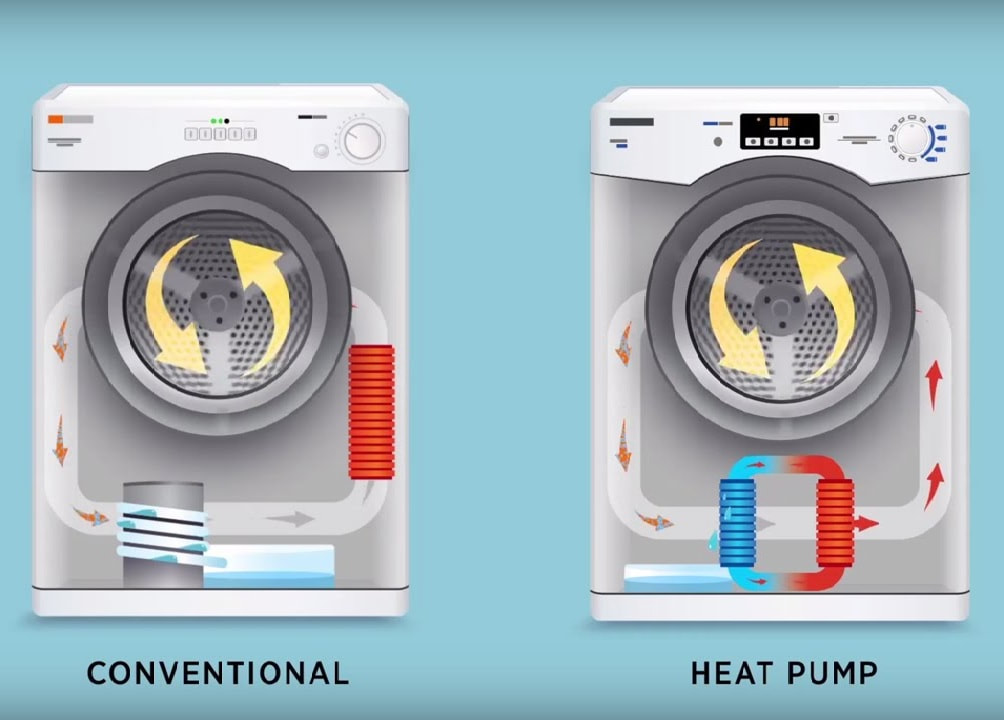

What is a heat pump tumble dryer? Starks Appliances Grimsby

Duke Energy Heat Pump Rebate In Florida

Air Source Heat Pump A Look Inside

Rebates On Havc Heat Pumps

Heat Pump Rebate Program 2022 • Superior COOP HVAC

Does Missouri Have Heat Pump Rebate

Heat Pump Air Conditioner Climate Air

Heat Pump California Rebate

TCN Heat pumps are catching on. New rebates, tax breaks may turbocharge the trend

2023 UPDATE Mass Save Residential Rebates Abode Energy Management

As an example, a consumer may receive a $400 rebate for an electric stove and a $440 rebate for an electric heat pump clothes dryer. 45. What may states do to help ductless homes using fuel oil or propane to electrify heat under IRA Section 50122?. For heat pump and heat pump water heater projects, the tax credit amount is 30% of the total project cost (includes equipment and installation), up to a $2,000 maximum. "So, if your project.