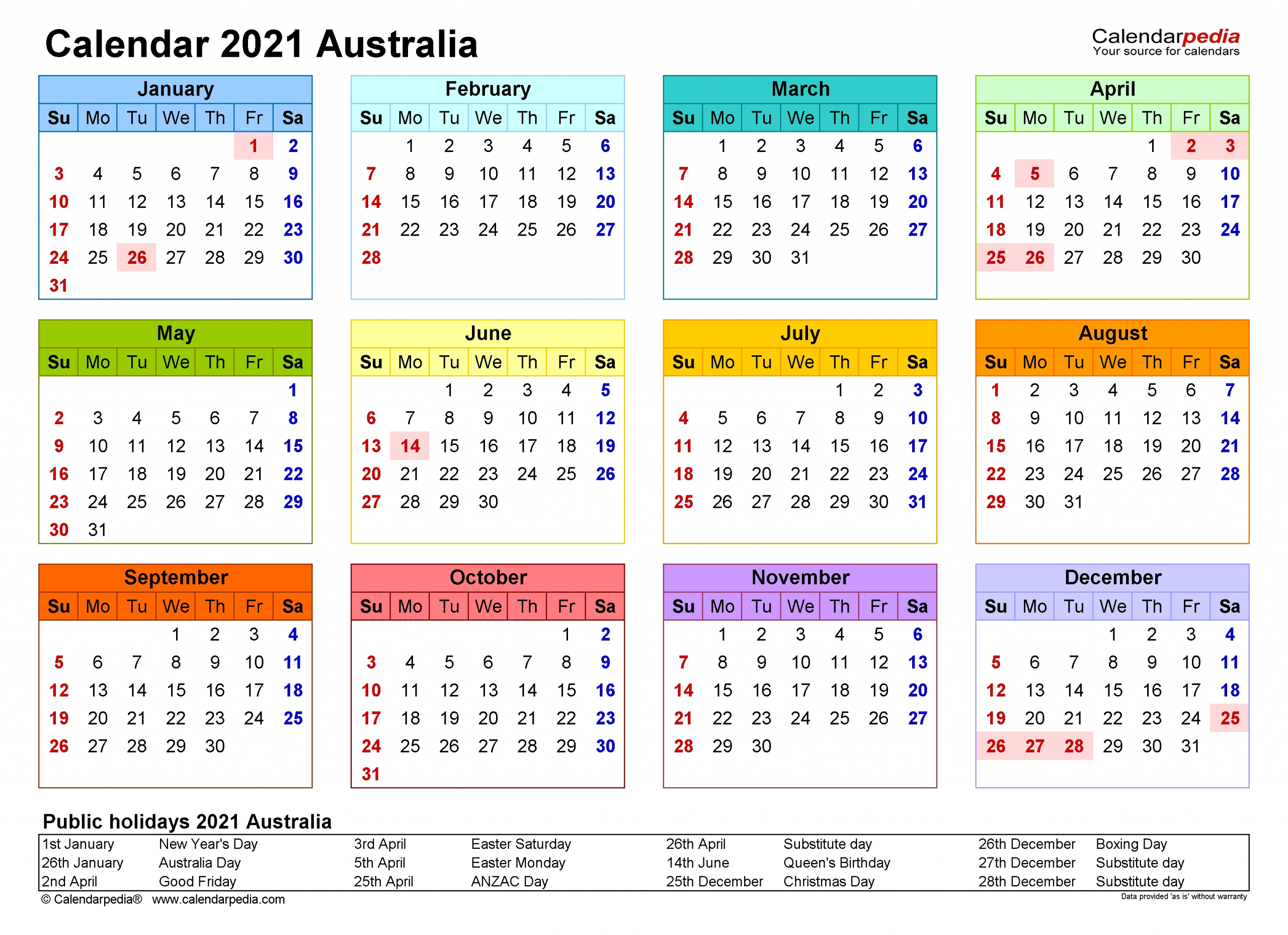

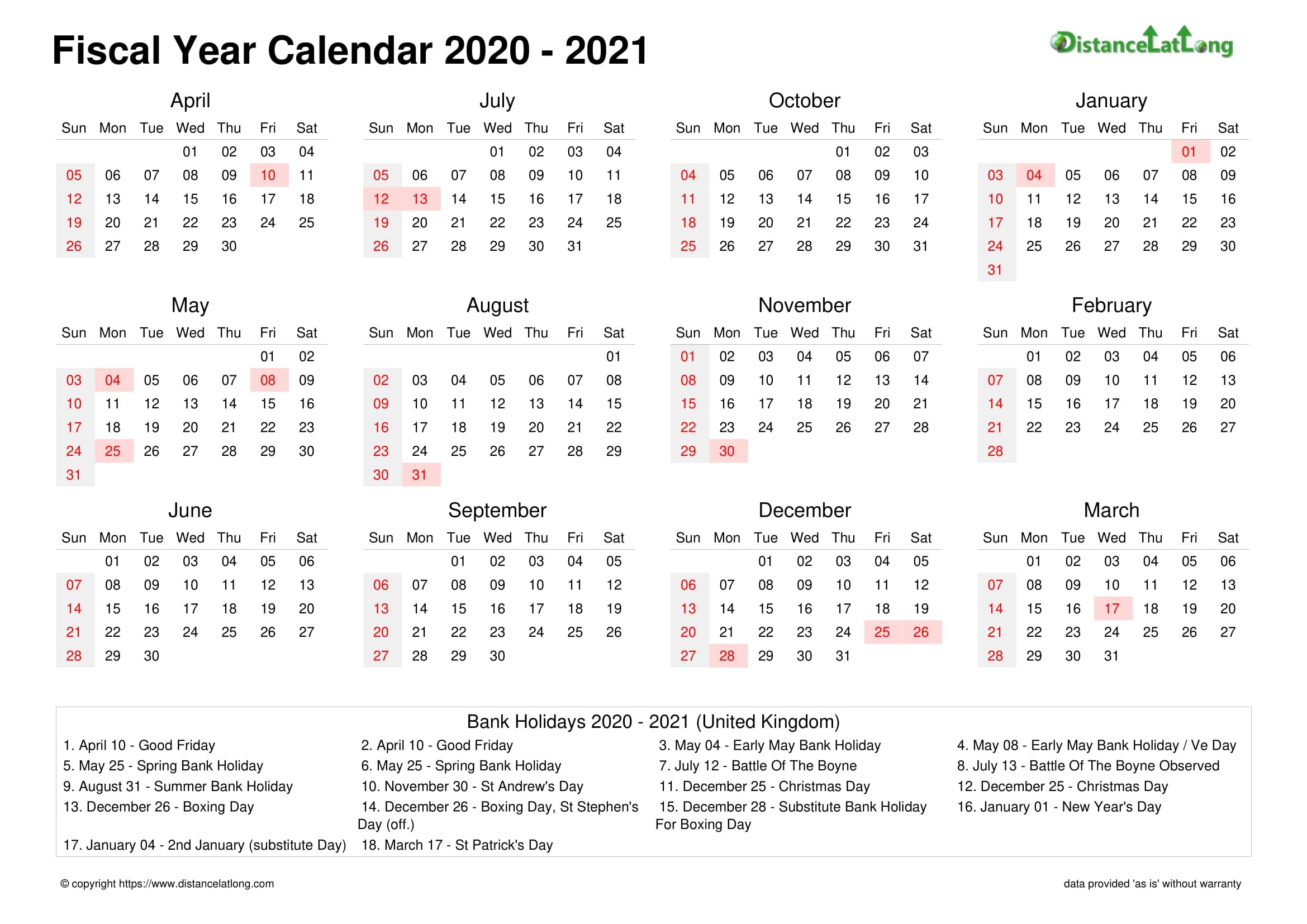

The end of financial year date in Australia for most businesses is 30 June. Now is the time to reflect on what has been, and what will be. It's going to be a busy few months but try implementing even one of our suggestions - it could save you money/tax.. Get in touch with the team at Verve Group by phoning us on (08) 8120 4877 or book an initial consultation with us online. The financial year is from 1 July to 30 June. The current 2020 Financial Year (FY) began on 1 July 2019 and will finish on 30 June 2020. EOFY means End of Financial Year, referring to 30 June and the period of time where.

Excel How to get Australian Financial Year from dates in Excel YouTube

Fiscal Year Meaning, Difference With Assessment Year, Benefits, And More Glossary by Tickertape

2021 Financial Year Dates Australia Template Calendar Design

It's that time again... End of Financial Year! HiRUM

The Financial Year for Australia One Click Life

End of Financial Year Cruise Sydney Harbour Exclusive Sydney Harbour Exclusive

End of Financial Year Text Quote, Concept Background Stock Illustration Illustration of

FINANCIAL YEAR END THAT FEELING WHEN YOU'RE UP TO DATE WITH YOUR APPROVALS Happy Squirrel

Text Sign Showing End of Financial Year. Conceptual Photo Revise and Edit Accounting Sheets from

Australian Money concept for savings, spending, or 30th June End of Financial Year sale Stock

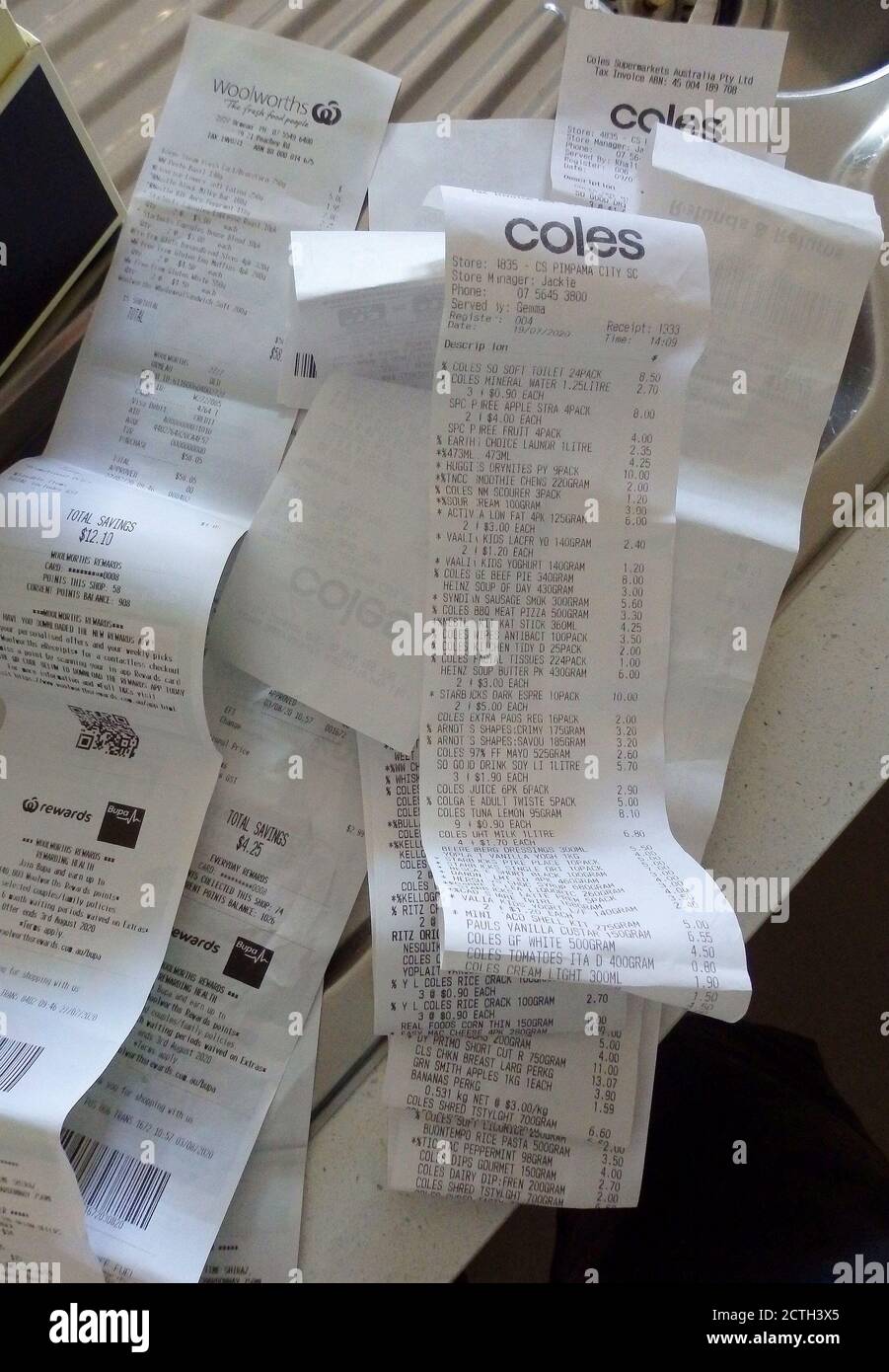

We thought you'd like to check these tips to help get organised before the End of Financial Year

Your YearEnd Financial Checklist Your Richest Life

Australia Gross Debt 1982 2022 australia

End of Financial Year Checklist Piranha Insurance Brokers

2021 Financial Year Dates Australia Template Calendar Design

Tax time, sorting of supermarket receipts for the end of the Financial Year, Australia Stock

Why 31 December Financial year end

Calendar Date for End of Financial Year, 30 June, for Australian Tax Year or Retail Stocktake

Australian End of Financial Year Checklist PayNow for Stripe

(PDF) The Choice of Fiscal YearEnd in Australia

The end of the financial year in Australia is on the 30th of June. It's an important time with both tax deadlines and opportunities for growth. Stay on top of your finances and start the next financial year in the best possible shape with this guide.. What are the tax dates in Australia? If you run a business or earn income in Australia, you need to know the deadlines and obligations for filing and paying your taxes. This article from Sleek provides a comprehensive overview of the tax dates for individuals, sole traders, partnerships, companies and trusts. Learn how to avoid penalties and plan ahead for the end of financial year.